Personal Finance

Published March 27, 2021, Page Last Modified October 14, 2024

[I started this document a while ago to document my thoughts and decisions related to personal finance. I expect to make poor decisions along the way and am eager for feedback. I’ll keep track of things in reverse-chronological order. Please don’t follow decisions here without taking your own personal financial situation into account.]

October 14, 2024

As I get older, I realize how economic preferences continue to change. Long term economic stability seems much more desirable than it did even 3 years ago. 10 year / 20 year / 30 year economic plans–while hard to fully appreciate and understand for any human (who is only alive for ~80 years total) seem extremely valuable for social coordination and planning.

April 27, 2023

Current opinions:

- unless it’s your full-time job, don’t spend much time trying to beat the market unless it gives you lots of joy (finance bros, sisters, people). Occasionally make bets when you feel like you have more confident and extreme beliefs about something than others and feel comfortable turning that belief into a financial wager.

- saving and not going broke is very important.

April 4, 2021

- Can perform portfolio tracking on google sheets using the template from Investment Portfolio Tracker — a Spreadsheet for DIY Investors (a). Can pull in crypto data through cryptofinance.ai (a). Can see total exposure to specific stocks through Tracking your ETF Underlying Holdings with Google Sheets (a)

March 26, 2021

Overall Feelings

I don’t want to think about investing often. Meeting some basic level of personal finance know-how seems incredibly worthwhile, but it also seems easy for ‘thinking about what to invest in’ and ‘playing the market’ to quickly eat into your headspace, take away time that you can spend working on much more worthwhile problems, and generally increase your cortisol levels. Of course, it can also feel very fun and exhilarating, and I think a lot of smart people I know really like trading because it is so stimulating (these friends are either working at Jane Street or playing with options strategies on Robinhood… but usually not both). However, my preferences going into personal finance are:

- Spend little time thinking about personal finance and trading (and create a system that lets me not check investments more than a few times a year)

- Make sure I’m not missing out on any super obvious things I should be doing with the money I start to make

- Expose myself to very high upside

- Learn about the mechanics of donating $ well

Risk-Reward Profile

I currently have high-risk tolerance, especially while I’m young and don’t have any other human beings depending on me. My current investment goals are to expose myself to the high upside from exponential technological progress that I expect to occur in my lifetime and do this at the risk of under-performing the market if things go wrong.

To make this concrete, the stock market’s average annual return is between 5-10%. Over 35 years, an initial investment will grow by between 5x-28x (1.0535 - 1.135).

With my risk tolerance, I’d be willing to take a bet where I have a

- 50% chance of 200x’ing my $ in 35 years

- 50% chance of 1x’ing my $ in 35 years

Of note:

broke: always re-reminding yourself that making huge amounts of money won't make you hugely happy

— Nick Cammarata (@nickcammarata) March 15, 2021 (a)

woke: non-linear currency

Key Ideas

- Compound interest is incredibly powerful and this is probably the most important thing to remember of all (compound interest is not only related to wealth, but also to skills, happiness, knowledge, etc. and these things are not independent and all feed into each other)

- Diversification is more important than you realize

- See Bridgewater on Geographic Diversification (a) and their “All Weather Strategy” (a)

- Not investing is also an investment decision (mainly, the investment in your country’s currency and the bet that inflation will not erode its value over time)

- 1000s of brilliant people are trying to beat the market full-time, every-day, from the moment they wake up until they go to bed, and these are the people you’re competing against

- Wei Dai pointing out that “The debate over EMH should perhaps be framed as ‘What skill level and assets under management do I need to make it worthwhile to play the markets instead of doing passive investing?'” in “Anti-EMH Evidence (and a plea for help)" (a)

- Just because you believe a company will grow a lot doesn’t mean you should buy it’s stock (it could be overvalued or the growth could be priced in)

- You don’t need to make money the way you lost it (don’t be blind to opportunities that are new to you and don’t be fixated on sunk costs)

- For example, if you lost $10k in the stock market, you don’t need to make it back by gaining $10k in the stock market. There can be an opportunity to make $10k with some random side hustle that isn’t investing in stocks

- Markets don’t price in long-tail events and exponential curves very well

- See LessWrong + the Rationalist community modeling Covid-19 much better than the entire world early on in January ‘20

- See Taleb’s “The Black Swan”

- See John_Maxwell’s post Why don’t singularitarians bet on the creation of AGI by buying stocks?" (a) pointing out that significant progress in AI (AlphaGo beating Lee Sedol) had virtually zero impact on Alphabet’s stock (GOOG) price

Other Observations

- People in finance who are now interested in blockchain and BTC still don’t deeply understand how blockchain works, what it actually accomplishes as a technology, and IMO are still not pricing in the prospects of BTC replacing gold in the next 50 years, let alone ETH (or some ETH killer) becoming a major currency that is used all across the internet and being used in incredibly novel ways

- Makes me way more bullish on both BTC and ETH (which also means betting some amount on ETH killers too, like DOT)

Initial Thoughts

- Keep 4-6 months financial runway in checking account But really, make sure not to go into debt. For example, if you have a 12-month apartment lease, make sure you will have enough money to pay for all the remaining months you will owe.

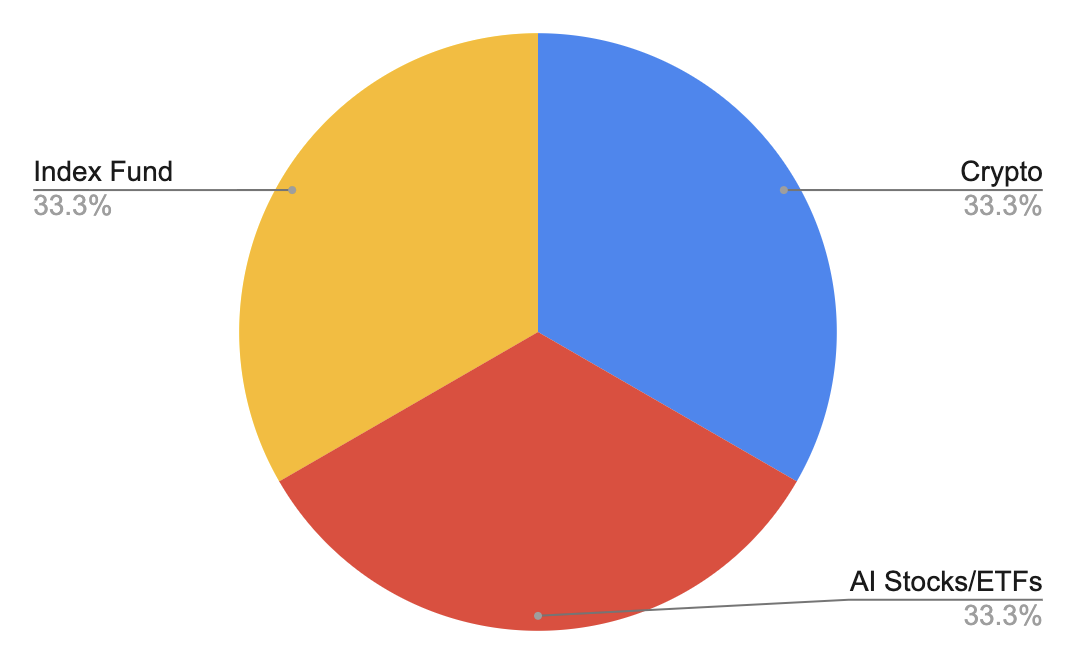

- Store the rest of my savings as investments in 1/3 Index Fund, 1/3 Stocks & ETFs that will grow with progress in AI, 1/3 Crypto

- The choice to do equal-weighting was just a naive first-pass at the allocation problem… what are better ways to think about this high-level allocation?

Recent Decisions Made

- Set up Roth IRA in M1 Finance brokerage account

- Max out Roth IRA this year and for all coming years ($6k / year)

- In future jobs, see if companies offer 401(k)s and 401(k) matching

- Handle investing using M1 Finance, Robinhood, Coinbase Pro

- Until I decide more specific investments I’m interested in making, split my portfolio to 33% S&P 500, 33% ARKK, 33% Crypto (mostly BTC/ETH)

Open Questions

- After choosing what to invest in, how should I handle portfolio allocation? (% in index funds, % in crypto, % in specific stocks/AI ETFs?)

- % in semiconductors, GPUs, cloud computing, MSFT, GOOG, AMZN, TSLA, AAPL, NVDA

- % in BTC, ETH, DOT, UNI, LINK, XLM, etc.

- Which portfolio (a) optimization (a) strategies (Mean Variance Optimization, Risk Parity, Kelly Criterion, etc.) are worth using?

- How often should I reweight my portfolio (if at all)? 1/year? Every 5 years for exponential bets?

- Should I use LEAPS (a) (long-term equity anticipation securities) for long-term investments?

- What’s the best way to diversify a portfolio so that investments are robust against changes in geopolitical power?

- Synthetic biology seems to also have enormous upside in the next 50 years? What’s the simplest way to gain exposure to this without much knowledge about the field?

- In 2017, I was aware of crypto being a bubble and sold my position before the market came tumbling down. I then bought back in once it settled. Going forward, I think it’ll be harder to reason about bubble-like behavior in regards to crypto, the tech sector, and index funds in general. People who lived through the dot-com bubble, what bubble-like market has felt most similar since? The 2017 crypto bubble? Current tech investments? The current crypto market? TSLA? Something else?

Current Ideas for Software That Would Make Decision-Making & Investing Easier

- Software that allows me to select companies and visualize a stacked area chart of their market caps over time (this would be helpful for looking at companies that are competing in the same markets and seeing how market-capture changes over time)

- Like this chart from OWID (but for stocks):

- Software that allows me to select companies for a portfolio and different weighting schemes (equal weighting, market-cap based weighting, custom weighting, etc.) and visually compare how those different weighting schemes perform over time (as line graphs)

- Like this chart from Bridgewater on Geographic Diversification (a):

- Like this chart from Bridgewater on Geographic Diversification (a):

- Software that optimally weights a portfolio according to some portfolio optimization strategy WHILE TAKING INTO ACCOUNT stated predictions I have about the future (i.e. not optimizing a portfolio on just past stock performance but instead after I list a set of quantified predictions X years into the future with Guesstimate (a)/QURI (a)/Foretold.io.

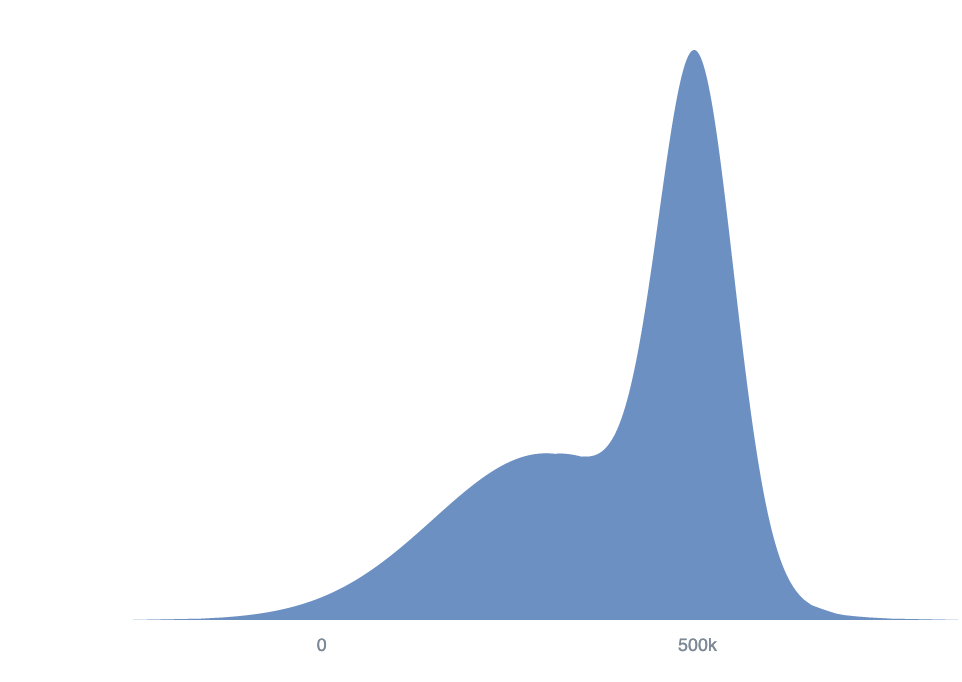

-

Price of BTC in 2050?

Price of BTC in 2050?

-

- Software that blocks me from selling investments during large market down-turns (2008 Recession / Covid Feb ‘20’) and encourages me to buy more during those infrequent events

Very Helpful Resources & Notes

(I’d recommend reading all of these resources in their entirety if you’re just starting to learn about personal finance. The notes are meant mainly for me and probably won’t be useful for a new reader. Khan Academy is extremely, extremely helpful and it’s so strange to realize that I was never taught about personal finance in high school or in college at Harvard and that Khan Academy is better at explaining how to think about taxes, retirement, and savings than the IRA, US government, or Harvard College)

Index Card Finance (a) (if you don’t plan on seeking alpha of any kind, this is probably the best advice to follow)

- Max you 401(k) or equivalent employee contribution

- Buy inexpensive, well-diversified mutual funds such as Vanguard Target 20xx funds

- Never buy or sell an individual security

- Save 20% of your money

- Pay your credit card balance in full every month

- Maximize tax-advantaged savings vehicles like Roth, SEP, and 529 accounts

- Pay attention to fees. Avoid actively managed funds

Khan Academy Personal Finance (a)

On W-4s

- W-4s describe how much money should be withheld from paycheck (doesn’t affect how much money you will pay each year because you will eventually need to pay a specific amount exactly to the government by tax day)

- More allowances = lower withholdings (less money collected for tax) = more money/paycheck

- Again though, this doesn’t actually mean more money in the long run. If you pay too much in taxes, you will get a refund. If you pay too little, you will need to pay more on tax day.

NerdWallet

On Retirement Accounts

- The main difference between 401(k)s and IRAs is that employers offer 401(k)s, but individuals open IRAs (using brokers or banks). IRAs typically offer more investments; 401(k)s allow higher annual contributions

- Fund a 401(k) first if your company offers matching dollars. Fund an IRA or Roth IRA first if your 401(k) doesn’t offer a match. If you max out the IRA, begin contributions to your 401(k).

Brian Tomasik’s “Assorted tips on personal finance” (a)

On Capital Gains

-

“donating appreciated assets is a good way to eliminate capital gains. You can use your current-year income to pay for costs of living, since not all of it can be deducted by charitable donations and thus you have to pay income tax on some of it regardless of how it’s used. By using current-year income to pay your bills, you avoid selling assets with capital gains and thereby paying more tax. Alternatively, if you have assets with capital losses, you should sell those to get a deduction.”

-

“If you absolutely must incur capital gains by selling rather than donating appreciated assets, try to postpone the capital gains as long as possible. The idea is that you’ll end up paying the same nominal amount in capital-gains tax regardless of when you cash out, but if you wait, the cost will have lower present value. For example, suppose you buy stock for $1000. You wait five years, and by this time it’s worth $1500. If you sold it now, you’d pay capital-gains tax on the $500 appreciation. But you don’t do that, and you instead wait another five years. Now it’s worth $2000. You sell it. You pay capital-gains tax on the $500 from the first five years and the $500 from the second five years. But the $500 payment for the first five years has been delayed, so its present value is less than it would have been had you paid the same amount five years ago.”

Ben Kuhn’s “Giving away money: a guide” (a)

- Figure out if your company does donation matching! Free money. Here’s a list of company donation matching (a)

How much to donate and when

- “Another small point in favor of donating less at the beginning is that if you save the money and later decide to donate it, you may benefit more from the tax deduction. That’s because, if your income increases, your marginal tax rate will also increase, so the value to you of a tax deduction will increase. This will probably be a fairly small effect, though: even if your income doubles later in life, your marginal tax rate won’t go up by more than 10%.”

Income and Deductions

- “The amount of tax you pay is based on your taxable income, which is calculated from your adjusted gross income (AGI) by applying a tax deduction for certain things that the government decided should be tax-exempt.”

- Making large donations: “people making large charitable donations are especially likely to have deductible expenses exceeding the standard deduction. In addition to donations, other things that may cause you to exceed the standard deduction are state or local income taxes or sales taxes (you may deduct one or the other but not both) and property taxes. If the sum of what you spend in these categories exceeds $6,000, you should file an itemized return, which is a little bit more complicated, but not much. If you’re itemizing, you need to keep documentation of any expenditures that you’ll deduct in case the IRS audits you.”

Marginal Tax Rates

- “a deduction is more valuable to you when your wages are higher. If today you make $20,000, then your marginal tax rate is 15%, so a deduction of $1,000 reduces your taxes by $150; but if next year you make $500,000, then your marginal tax rate is 39.6%, and the same deduction of $1,000 reduces your taxes by $396.”

Donor Advised Funds

- Because of these downsides, DAFs are mostly only useful if you expect to run into the tax deduction caps later (probably good if you are super rich)

Comments powered by Talkyard.